Since moving out of my parents’ house for the first time in 2004, I’ve thought it really important to be aware of my finances. Granted, I was making $35,000 a year so I had to be really careful. Still, in the effort of trying to save money perhaps to someday buy property or just in the attempt to build a comfortable nest egg, I try to be as aware of my spending habits as possible.

Since moving out of my parents’ house for the first time in 2004, I’ve thought it really important to be aware of my finances. Granted, I was making $35,000 a year so I had to be really careful. Still, in the effort of trying to save money perhaps to someday buy property or just in the attempt to build a comfortable nest egg, I try to be as aware of my spending habits as possible.

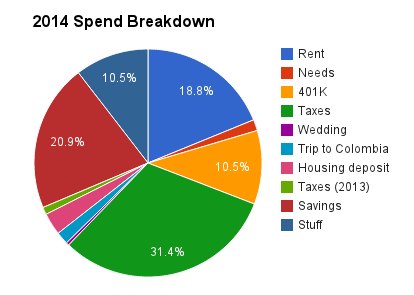

So here is the breakdown of how far my paycheck went in 2014:

| Rent | 18.8% |

| Needs | 1.6% |

| 401K | 10.5% |

| Taxes | 31.4% |

| Wedding | 0.4% |

| Trip to Colombia | 1.8% |

| Housing deposit | 3.1% |

| Taxes (2013) | 1.0% |

| Savings | 20.9% |

| Stuff | 10.5% |

The saddest thing is that the largest chunk, about 1/3, of my total pay went to taxes. This is a reality and I would encourage everyone to be aware of exactly how much money they are actually taking home with them. Sometimes people lock onto their salary figure as the amount of funny money they have to play with but it’s simply not true.

Rather happily, the second largest chunk of my total pay went into my savings– yay! I aim to put 25% of my pay into savings. I think 20% is a great effort. I would be pleased with 15 % too but I think 20% is a solid effort. And then understandably rent is the next biggest chunk. I live in San Francisco where my monthly rent is $1600 so this is just what it is.

I spent about 10% on “stuff” which admittedly I don’t have a lot of information on. I use my credit card for most purchases so in theory, I could use something like mint.com to see where I’m spending. But I have found the analysis to be incorrect in the past so I’m not too sure. Stuff has included things like meals out, groceries, clothes, entertainment and other fun stuff.

* Update: I received feedback that “needs” was too ambiguous. I included in this category everything that I was obligated to pay, including cellphone, internet, and energy bills and gas.

Things I have been doing well

1) Food. I eat out very infrequently if I can avoid it. I want to make the most of the wonderful food SF has to offer but I also know that buying prepared food is one of the biggest ways that a person can spend money. If I’m hanging out, I will definitely eat out because I consider that eating and enjoying and socializing. However, I try to prepare food for “functional meals”– for example, my lunches at work. Eating lunch in the FiDi can range from $8-15. At that rate, I could spend $2000-3000 per year on food alone. I try to buy lunch maybe once a week (like from food trucks, because they are yummy!) and my company caters lunch once a week. But otherwise, I try to make my own food which keeps my costs lower.

2) Clothes and fun stuff. I have been very honest I think that I love buying things but that it has led me to accrue a ton of crap, which I have moved multiple times in the past few years. So I made the decision to start getting rid of things– having a garage sale that yielded me almost $100 and selling items on eBay. I also just sent off a bag of stuff to ThredUp. On the other side, I think I have been pretty reasonable about buying new things. I try to pass objects thorough a more stringent filter, asking myself, “Do I love this?” I’m not as susceptible to buying things simply because they are on sale. I need to keep working on this but I think I have made solid progress this year.

3) Transportation. This is less an active choice but more luck as well as making some good decision making. I chose apartments close to my workplace which granted wasn’t the funnest but at least meant that I spent minimal time commuting and less money on gas. Now that I live in SF, I use the bus system pretty extensively and happily my company pays for my pass. So my total transportation costs per year are like $15 (processing fees). I try to take Lyfts only when I need to (like late at night or when safety is an issue). I also didn’t bring my car to SF and don’t plan to. I will be selling my car sometime in the next month or so which means I won’t need to pay for storage insurance or registration. This should net me a little over $3,000 for my 12 year old vehicle, which I have kept in really great shape. It also means that I won’t need to pay the $500-1,000 it was costing me each year in maintenance.

4) Entertainment. I wanted to see if I could do without cable since my bill was becoming way too high. So in March, I got rid of cable and kept internet only. My monthly bill therefore is $40 and not $60-80. I use Netflix instead. I’ve been happy with this choice. I also borrow library books a bunch and I’ve been super happy with the SJ library and now with the selection at the SF library. So I’m happy that I’ve been able to keep my entertainment costs reasonable.

Things I need to work on in 2015

The only part that I can really work on is the “stuff” category. I am going to continue to try to be prudent in what I purchase. I had to buy a fair amount of new furniture for my new apartment. I would guess about $250 worth. So that shouldn’t need to continue in 2015. I’ll be honest that I’ve been lusting after a new couch. But I don’t need a new couch so I’m going to have to work to control those urges. And generally, I need to keep monitoring my purchase of new clothes and shoes and try to keep purging my wardrobe of things I don’t need.

On a side note, I was unemployed this year from mid-July until early September (6 weeks total). I applied for unemployment and though I was getting confirmation stubs, I never received payment. I just found my EDD card (it’s how unemployment funds are dispersed) from my first bout of unemployment a few years ago. I just checked the balance and $3000 was deposited there! Woot. So what I’m going to do is use this on only groceries and necessities in 2015. I am going to update my spend on blog entries throughout the year, the theme being “How far does $3000 go?”

So that’s it from me. I hope everyone is being fiscally responsible. Try graphing out your year’s spend or begin tracking how you use your money. You might find the results interesting!